Status: Approved

Date of entry into force: 1 January 2020

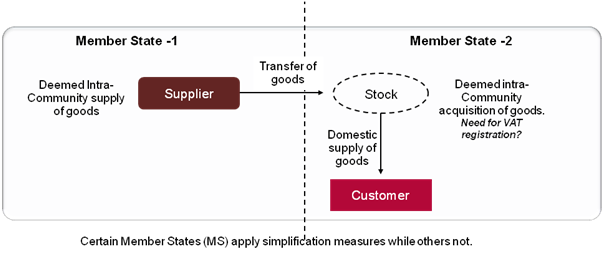

Scenario before 1 January 2020

Goods moved from one Member State to another under a call-off stock arrangement resulted in a transfer of own goods performed by the supplier, which raised two different taxable events:

- a deemed intra-Community supply of goods in the Member State of dispatch; and

- a deemed intra-Community acquisition of goods in the Member State of arrival of the goods.

The deemed intra-community transactions resulted in the obligation of the supplier to be VAT registered in, our example above, Member State -2. The later transactions within Member State-2 from the stock (the supplier) to the person acquiring the goods constituted a domestic supply where reverse charge mechanism would mostly apply (B2B transactions).

Note: before 1 January 2020, many Member States (a total of 20) had already in place simplification measures in order to avoid the supplier having to be VAT registered in the Member State of the location of the stock. However, each of those Member States had their own conditions and requirements which created a situation reign by disharmonization.

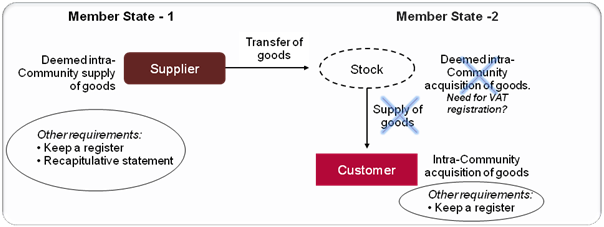

Scenario from 1 January 2020

From 1 January 2020, the situation changes radically in a way in which the call-off stock arrangement is not considered to be any longer as a deemed supply of goods – therefore, there will not be taxable event hence no VAT obligations in this phase of the transactions.

In the phase in which the goods are supplied to the customer in Member State-2 (see example above) is when the supplier will perform an intra-Community supply of goods in the Member State of dispatch of the goods (zero rated when meeting all the requirements) and that the recipient will be liable for the intra-Community acquisition of goods in the Member State where those have been stored.

For this quick fix to apply, different requirements must be met:

- dispatch or transport of goods by a supplier or by a third party on his behalf to another Member State with a view that those goods will, at a later stage and after arrival, be supplied to a customer based on an existing agreement between both parties;

- both the supplier and the customer are taxable persons for VAT purposes and the latter has a VAT identification number in the Member State of destination;

- the supplier is not established or does not have a fixed establishment in the Member State of destination;

- the identity and VAT identification number of the customer are known to the supplier prior to the start of the transport;

- the supplier records the transport to the stock in a register provided for in article 243(3) of the VAT Directive. The same article also establishes the same obligation for the taxable person to whom goods are supplied under call-off stock arrangements. However, the non-fulfilment to keep a register by the recipient does not imply the non-application of the quick fix but probably an administrative penalty in the respective Member State;

- the supplier mentions the identity and VAT identification number of the customer in his recapitulative statement and any change in the information submitted; and

- the goods are supplied to the customer within 12 months after arrival of the goods in the Member State of destination.

The simplification should apply, when meeting all the substantive requirements above mentioned, to the following scenarios:

- Supply to the intended acquirer;

- Substitution of the initial recipient by a newly appointed intended acquirer under the umbrella of a new call-off stock arrangement;

- Return of the goods to the Member State of dispatch within the time limit of 12 months; and

- Goods lost, stolen or destroyed when considered small losses (in line with the explanatory, small losses should amount below 5% in terms of value or quantity of the total stock)

However, the simplification should not apply to the following situations:

- Goods are sold to another customer or transported onwards to another Member State or third country;

- Goods are lost, stolen or destroyed (other than small losses mentioned above); and

- The period of 12 months is exceeded – In the case of bulk goods, the FIFO (first in, first out) accounting method applies in determining the 12-month period

The immediate consequence when the quick fix ceases to apply is the obligation of the supplier to be registered for VAT purposes in the Member State where the goods are stored.

Our VATinsights:

- This quick fix results in a uniform application of EU VAT rules with regard to call-off stock arrangements and eliminates the need for suppliers to account for VAT on the deemed intra-Community acquisition of goods in every Member State where they are transferring goods, thus reducing the administrative burdens for businesses. However, the quick fix bring to the table new administrative obligations like keeping a call-off stock register.

- Requests of registration coming from businesses only making exempt intra-Community acquisitions of goods followed by supplies subject to the rule of reverse charge mechanism should not be refused by Member States.

- It is necessary for businesses to control all their call-off stock arrangement in a way that allows them to foresee in advance when the quick fix for those will cease since they will need to be VAT identified in the country where the goods are stocked in order to apply the zero-rate to the deemed intra-Community supply of goods.

- After the entry into place of this quick fix, the recapitulative statement will be of special importance, since this reporting obligation becomes a requirement in order to apply the simplification measure. Businesses should guarantee the internal processes to make sure those are take care properly as well as train their staff.

- The VAT consequences of any change in the original call-off stock arrangement should be duly reviewed.

Suggested reading:

Jordi Sol Rosa, 2020 Quick Fixes: Simplification or More Complexity for Businesses? – The Explanatory Notes, 31 Intl. VAT Monitor 3 (2020), Journal Articles & Papers IBFD (accessed 30 May 2020) – https://www.ibfd.org/IBFD-Products/Journal-Articles/International-VAT-Monitor/collections/ivm/html/ivm_2020_03_e2_4.html

Relevant documents and links:

Implementing Regulation 2018/1912

National transposition measures communicated by the Member States concerning VAT quick fixes

Explanatory Notes on the EU VAT changes in respect of call-off stock arrangements, chain transactions and the exemption for intra-Community supplies of goods (“2020 Quick Fixes”)